Many care homes are close to collapse due to falling occupancy levels and rising costs. Some are more vulnerable due to the debts that they have been burdened with and the way they operate. Whilst the promise of extra funding is vital, the opaque financial structure of the major care home groups means that some of this funding will leak out as hidden profits.

Our forensic analysis of the adult care home industry finds that some of the largest for-profit care home providers operate in a way which hinders accountability of their true profitability; increases their financial fragility; and crucially locks in high future costs for care home beds. However, at the same time, many of the smaller for-profit and the largest not-for-profit providers are making low levels of profit, without damaging the public interest.

To understand these differences in structure and their wider implications we looked at the accounts of over 830 companies in the adult residential and nursing care home industry. We examined how they spent the income that they received and also how much they borrowed and from whom.

When examining how they spent their income we paid particular attention to the amounts allocated to both debt repayments and rental costs, in addition to profits made (before tax) and director’s fees. We did this because there has been evidence that some of the spending on these two categories of standard business cost is actually a form of hidden profit extraction. Taken together all four of these costs (debt repayments, rental costs, profit before tax, and directors’ remuneration) represent potential leakage out of the care home sector, as they do not go directly to caring for residents through providing food, facilities, laundry, entertainment, or paying for staff, and so merit critical analysis.

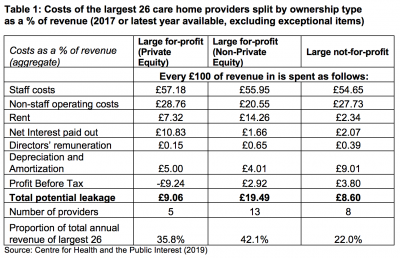

There is a large variation in the levels of potential leakage across the different types of care home provider based upon size and company type. The 784 small to medium-sized care home providers identified have a leakage rate of £7 out of every £100 of income, but this was almost double at £13 out of every £100 for the largest 26 providers. There are legitimate reasons for this variation, and it was within the largest 26 care home providers that we found the most important differences and areas for concern.

All of the largest 26 providers spend similar amounts on staff costs as expected in a labour-intensive industry. However, there are big differences in the total potential leakage rates, due to debt repayments (‘Net interest paid out’) and rent, both areas where hidden profit extraction can occur. Table 1 shows how the revenues of the largest 26 providers are allocated.

On closer examination, we found that a substantial proportion of the debt and rent payments being made by these providers are to related companies. In terms of their debts, the 5 largest private equity-owned or backed care home providers have borrowed £35,072 for each care home bed that they own, which leads to an interest cost of £102 per bed per week, that’s 16% of the average weekly fee for residential care. This contrasts to the 8 largest not-for-profit providers who have a debt of £21,069 per care home bed and interest costs of £19 per bed per week.

In total the 18 largest for-profit providers owe 59.2% (£1.47bn) of their debts and pay 49.5% (£117m) of their annual interest payments to (often offshore) related companies. These debts are at high interest rates (typically 7-16%) which suggests that some of the money going out as debt ‘costs’ is a form of hidden profit extraction and a method of tax avoidance.

As with debt, rent payments are often to related companies which makes it hard to discern whether the rent paid is reasonable, or a way of moving profits to (often offshore) related property companies. 7 of the 18 largest for-profit providers spend between 15-32% of their income on rent payments, totalling £264m a year. This stands in marked contrast to the 8 largest not-for-profit providers, which spend an aggregate of 2% of their income on rent, totalling £25m a year.

Taken together, the significant amounts being spent by some of the largest for-profit care home providers on rent and debt payments to related companies obscures transparency over how profitable they really are, making it hard to understand how much extra money they actually need to continue operating and make a fair return. In addition, the high levels of debt loaded onto care home beds threatens their financial sustainability, with gearing levels of almost 600% common for some.

Aside from concerns over transparency and increased financial fragility, the industry’s current financial structure is also locking-in high costs for future care beds. There is a growing need for more care home beds and yet the proportion of beds supplied by low-profit smaller (often family-run) care home businesses is falling as their owners retire. In their place, the largest for-profit care home providers are expanding.

These large for-profit providers have higher levels of leakage via hidden profit extraction, but also are predominantly expanding using a method called ‘sale and leaseback’. This involves selling their existing care home properties to an investor and then renting back these same properties for an annual rent. The money received is then used to buy or build more care home properties.

Sale and leaseback may be one of the few ways that these companies can expand but it raises three concerns. Firstly, the investor who purchased the property will expect a return from their rent charges, and when the information on these agreements was available we found that rent payments typically rose by RPI (an inflation measure) + 2-4% a year. This puts pressure on future care home fees to rise in tandem to cover this growing cost, a burden borne by local authorities and those forced to pay privately for their own care. Already the 9 providers with identifiable sale and leaseback arrangements pay the highest average rent at £14.32 out of every £100.

Secondly, 5 of the 9 providers with sale and leaseback arrangements have them with related companies, which raises the risk that rent charges will be set artificially high to reduce the stated profit of the care home company, and facilitate tax avoidance with rent payments going to the (often offshore) related property companies.

Thirdly, the type of care home being built is large 60-120 bed homes, because a certain size is needed to generate sufficient returns for investors. However, such large homes are not necessarily desirable for their elderly residents and bigger homes are associated with a worse quality of care. These also being built to target the self-paying segment of the care home market, and not the needs of local authority-funded care.

In summary, the financial structure of some of the largest for-profit care home providers means that the funding boost will not be sufficient to ensure a transparent and resilient care home industry, either during or after the current crisis. We recommend a Care Home Transparency Act which mandates greater financial transparency, the regulating out of unsatisfactory financial models, and government capital made available to a variety of care home providers, in order to start fixing these deep-rooted problems affecting the industry.

This article was originally published on the LSE British Politics and Policy blog, and can be found here.

Support Our Work

CHPI is the only truly independent health think-tank dedicated to the founding principles of the NHS. To continue our work keeping the public interest at the centre of health and social care policy, we need your help.

Please support CHPI so we can continue to impact the health policy debate.